How Does a South Carolina Online Line of Credit Work?

Simple Process

Apply in minutes with our

quick online application

Quick Approvals

Submit application and

get approved.

Instant Funding*

Money credited into debit card

or bank account - instantly. *Bank participation

required.

Are you between paychecks and worried about bills? In South Carolina, an online line of credit from Advance Financial can help you make ends meet until your next payday! Get cash now for your rent, utility bills, or whatever you need, and breathe a sigh of relief.

Whether you are in Charleston, Greenville, Hilton Head Island or Myrtle Beach, Advance Financial understands how hard it can be for you to get through difficult financial times. That's why we offer an unsecured loan online up to $4,000 in South Carolina.

Once you qualify, you can either take all the cash, up to your approved credit limit or just what you need. And you can pay back in minimum monthly payments or repay the full balance without any prepayment penalty.

Flexible Loans That Fit Your Ongoing Needs

Flexible Payments

Fixed Rate

Access Your Cash Anywhere

Line of Credit Loan FAQs - South Carolina

What is an online line of credit loan?

It is an unsecured open line of credit and comes with credit limits. You will only be charged with interest and fees only for the amount you withdraw.

What do I need to get an online line of credit in South Carolina?

- Photo ID

- Proof of income

Line of credit vs. credit card cash advance

A personal line of credit and a credit card are both unsecured revolving credit products. A personal line of credit may have a higher annual percentage rate (APR) than a cash advance on a credit card, but you may be able to borrow a larger amount on a line of credit

Why choose Advance Financial?

- Simple loan application

- Quick loan processing

- Fast funding

- Flexible Payments

- No prepayment penalty

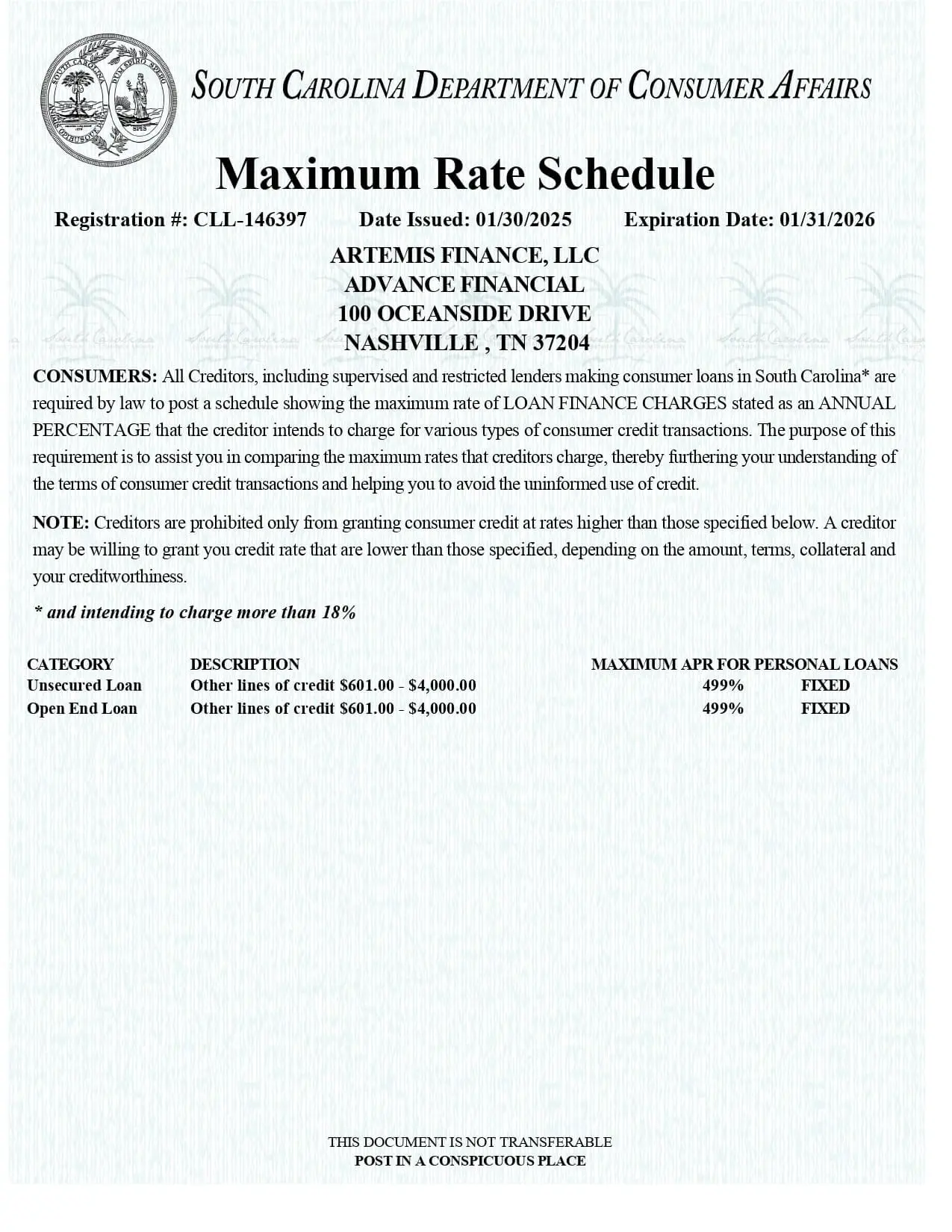

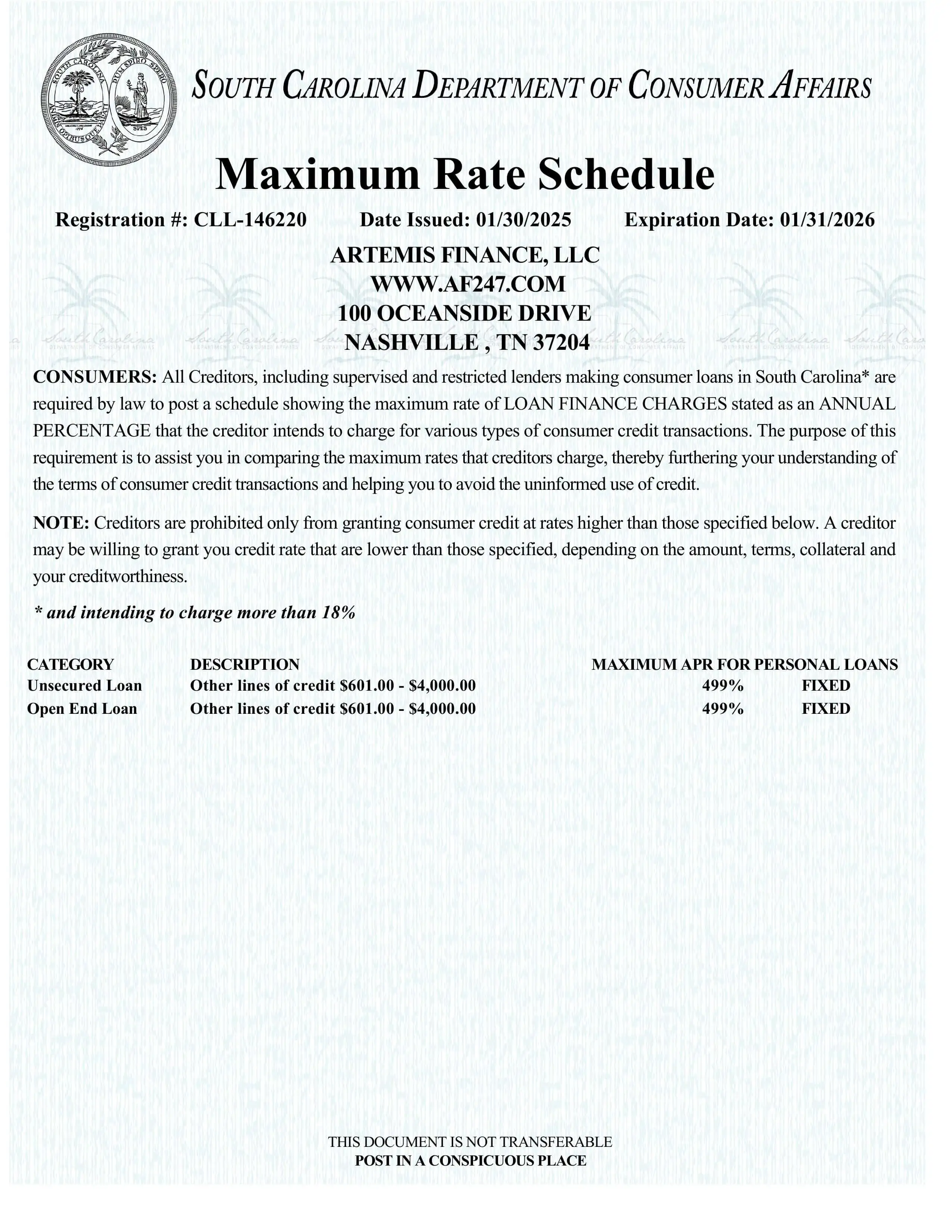

Line of Credit Rates and Terms in South Carolina

Advance Financial loan agreements are governed by the applicable laws of the State of South Carolina.

Maximum Amount

The maximum Line of Credit amount at Advance Financial is $4,000.

You can pay back your Line of Credit anytime and you only pay interest for the amount of time you keep the money.

How much can I receive on a Line of Credit?

A withdrawal from your Line of Credit is called a Cash Advance. Cash Advances can be requested from $610 up to your available Credit Limit.

How much does it cost?

South Carolina Interest Rates and Interest Charges

| APR* for Cash Advances | 450%  |

| Paying Interest | You will be charged periodic interest from the date of each transaction |

* Annual Percentage Rate: The APR is the cost of your loan expressed as a yearly rate.

This is the maximum rate we charge. Some borrowers may qualify for lower rates.

This is the maximum rate we charge. Some borrowers may qualify for lower rates.

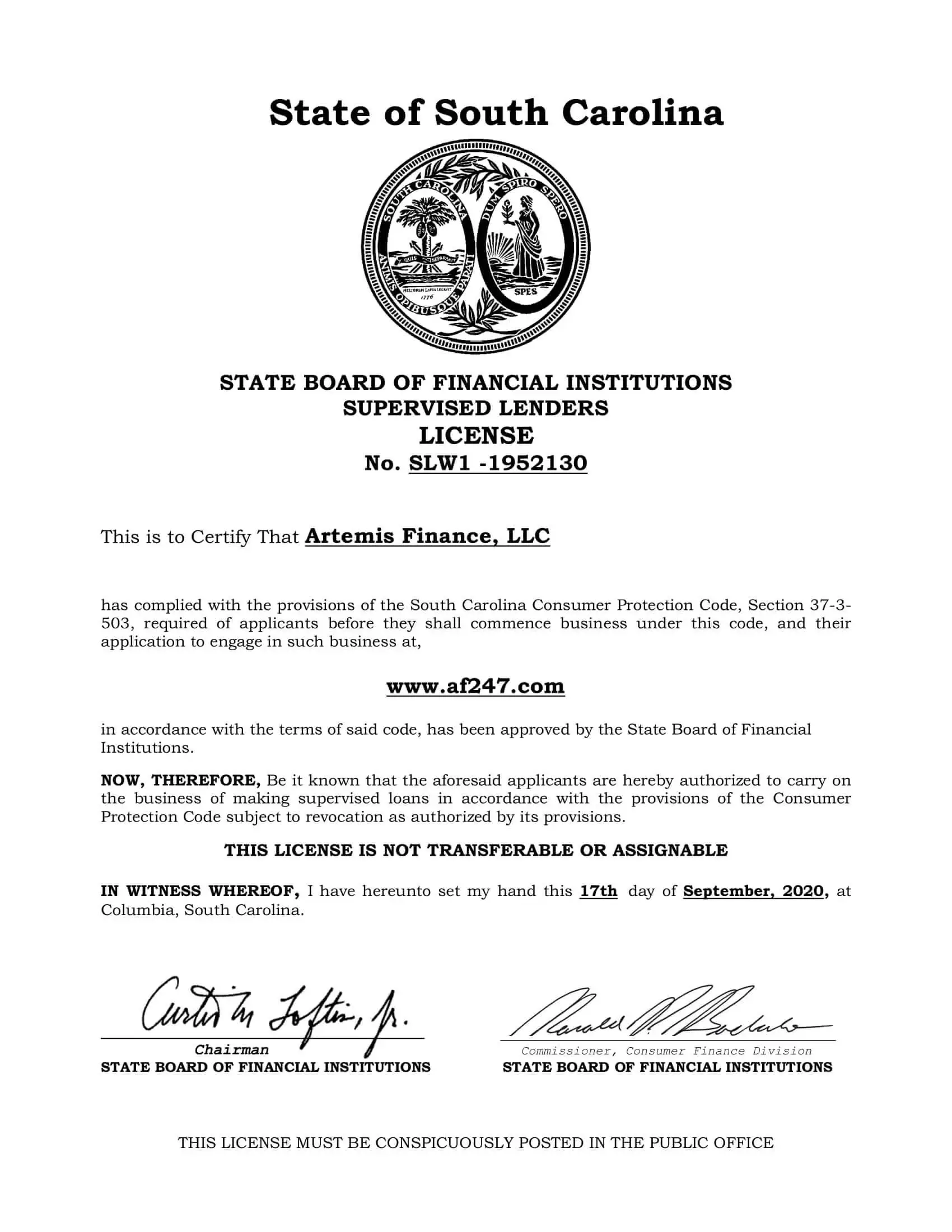

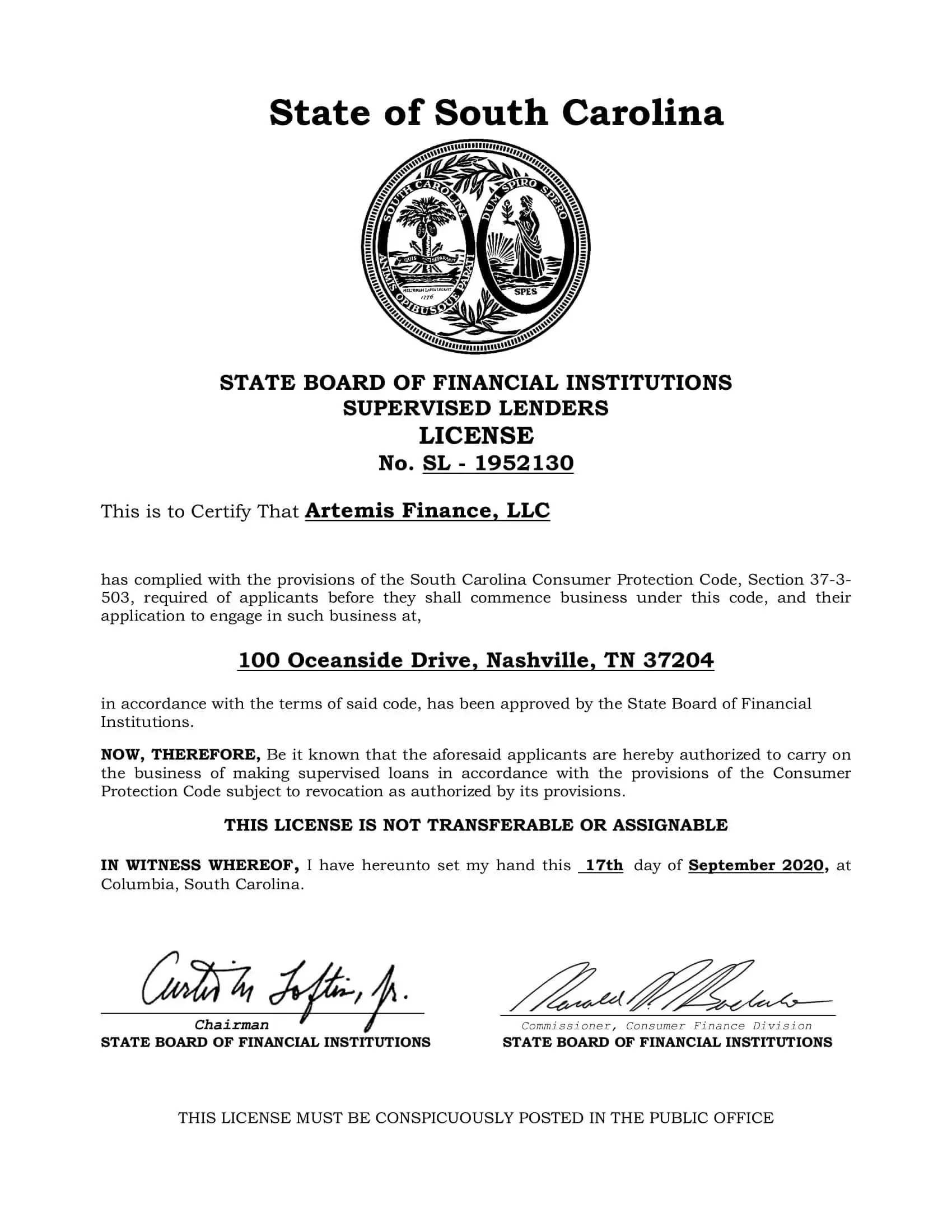

To See Your State's Licenses

Disclaimers

Online lines of credit from $610 to $4,000, subject to underwriting and approval. Minimum initial cash advance is $610.

To See Your State's Brochure

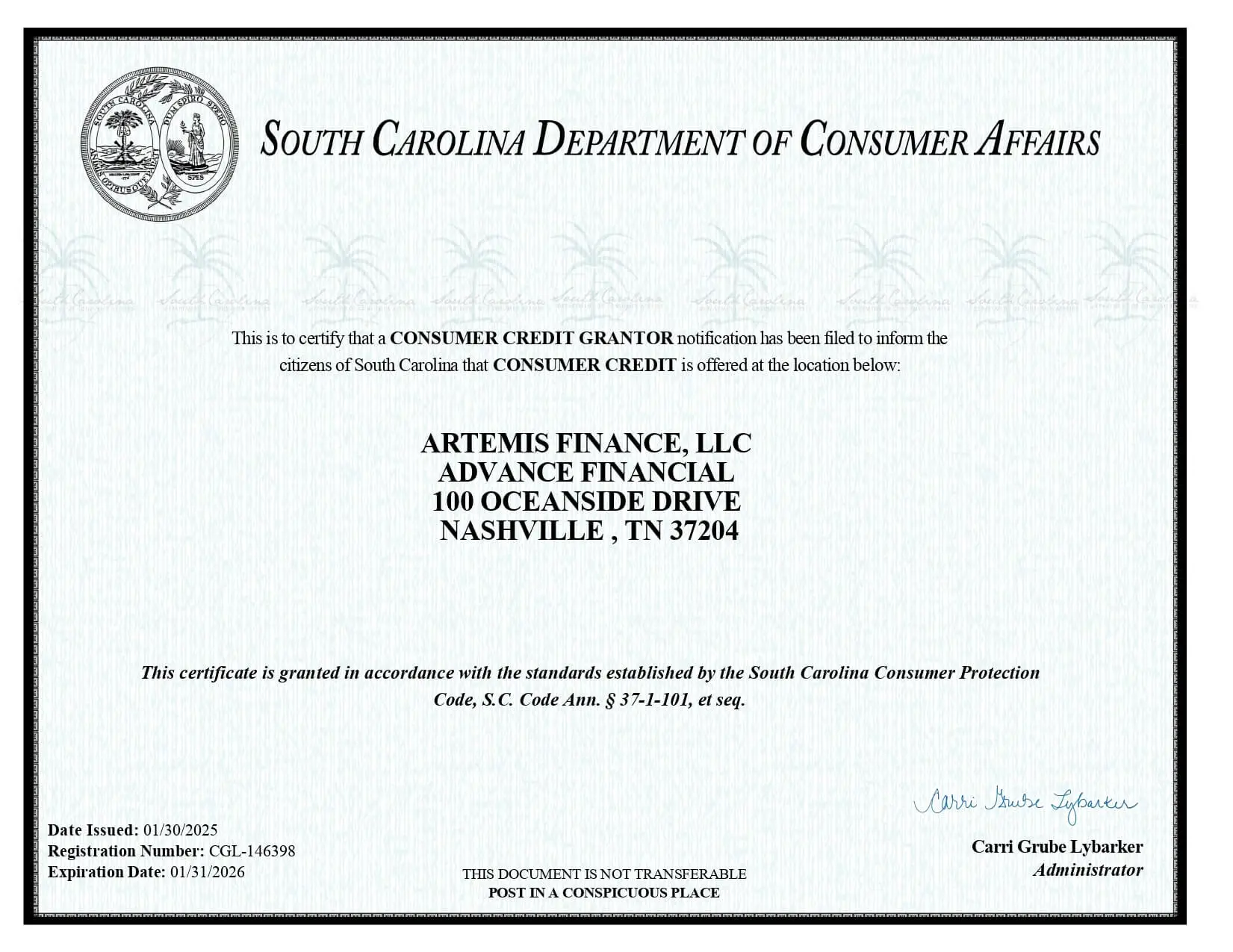

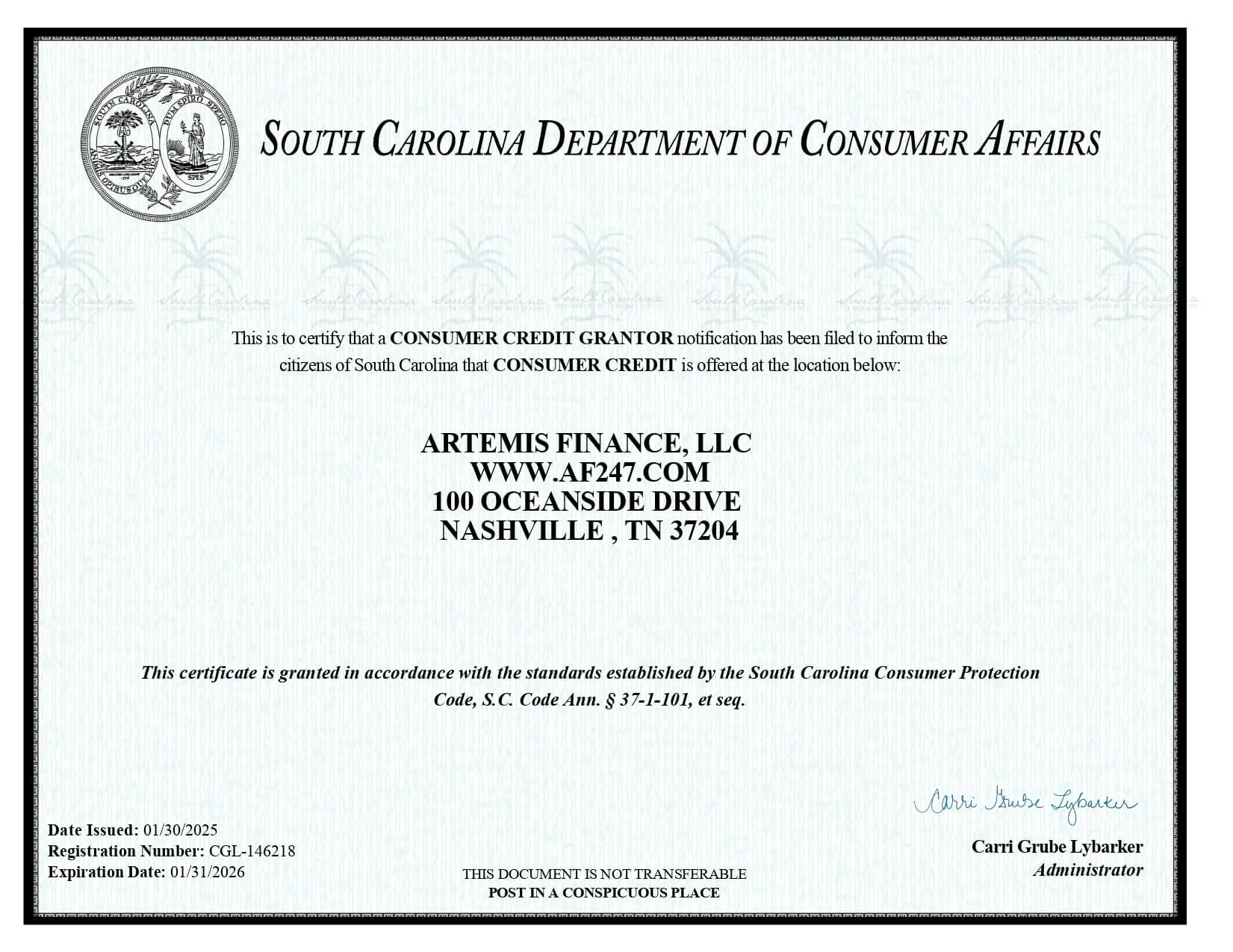

To See Consumer Grantor Notifications

To See Your Max Rate Schedule Licenses

Alabama

CC Flow offers an online Line of Credit Loan up to $4,000 in Alabama for life's unexpected expenses.

Alabama is home to the largest space museum in the world in Huntsville: the U.S. Space & Rocket Center.

Arizona

If you live in Arizona and need cash fast, check out the CC Flow online Line of Credit Loan. You could borrow up to $4,000 in Arizona.

Arizona is known as both the Grand Canyon State and the Copper State. The capital city, Phoenix, is the hottest city in the US.

Delaware

If you live in Delaware and need some fast cash, Advance Financial offers an online Line of Credit Loan from $100 up to $4,000.

Did you know that Delaware was the first state in the United States.

Florida

If you live in the Florida and need cash fast, check out the CC Flow online Line of Credit Loan. You could borrow up to $4,000 in Florida.

Did you know that Florida has the longest coastline in the contiguous United States and is the only state to border both the Atlantic Ocean and the Gulf of Mexico?

Hawaii

If you live in Hawaii and need cash fast, check out the CC Flow online Line of Credit Loan. You could borrow up to $4,000 in Hawaii.

The world-famous Dole Plantation on the Hawaiian Island of Oahu is home to the largest maze in the world.

Idaho

Do you live in the Gem State? Advance Financial offers an online Line of Credit Loan in Idaho from $100 up to $4,000.

Do you know Idaho is nicknamed the "Gem State" because of its natural beauty?

Indiana

If you live in Indiana and need cash fast, CC Flow is here to help. CC Flow offers an online Line of Credit Loan up to $4,000 to help with life's financial challenges.

Did you know that on Sept. 5, 1885, the first gas pump was born in Fort Wayne, Indiana? The Indianapolis 500, also known as "The Greatest Spectacle in Racing," takes place in the state's capital.

Kansas

If you live in Kansas and need cash fast, we're here to help. We offer an unsecured Line of Credit Loan up to $4,000 to help with life's financial challenges.

Fun fact: Did you know that Kansas is known as the Breadbasket of America because it's the nation's leading wheat producer?

Kentucky

If you're in need of cash and live in Kentucky, look no further than CC Flow. CC Flow offers an online Line of Credit Loan in Kentucky up to $4,000.

Did you know that Kentucky is known as the horse capital of the world and is home to the Kentucky Derby?

Louisiana

It can be hard to get a loan from a bank. CC Flow is here to help. A CC Flow online Line of Credit Loan in Louisiana could get you up to $4,000 fast. Apply now and get the cash you need.

Do you know who's from Louisiana? Famous Americans from Louisiana include Jerry Lee Lewis, Ellen DeGeneres, Louis Armstrong, Reese Witherspoon, Peyton Manning, and Tyler Perry.

Michigan

If you live in Michigan and need cash fast, CC Flow is here to help. CC Flow offers an online Line of Credit Loan up to $4,000 to help with life's financial challenges.

Fun fact: Did you know that Michigan is the only state that touches four of the five Great Lakes.

Minnesota

You're living in the land of 10,000 lakes and could use a little extra cash. CC Flow is here to help. With an online line of credit loan up to $4,000 in Minnesota, you can get the cash you need fast. Apply now and see how much money you could borrow.

Fun Fact: Minnesota is home to many inventions that you probably use. This includes scotch tape, pop-up toasters, water skis, in-the-ear hearing aids, and grocery bags with handles.

Mississippi

Need cash fast? CC Flow offers an online Line of Credit Loan up to $4,000 in Mississippi.

Fun Fact: There are several famous people who were born in Mississippi, including Elvis Presley, Oprah Winfrey, B.B. King, and Jimmy Buffett.

Missouri

If you live in the "Show Me State" and need cash fast, check out the Advance Financial Line of Credit Loan. You could borrow anywhere from $500 up to $4,000 in Missouri.

Supposedly the ‘Show Me State' expression began when Congressman Willard Duncan Vandiver stated, "I'm from Missouri and you've got to show me."

Montana

CC Flow offers an online Line of Credit Loan from $25 up to $4,000 in the great State of Montana. It's easy to apply online.

Here's some interesting information. The largest snowflake ever observed was nearly 15 inches wide and was recorded in Montana on January 28, 1887. Also, remember daredevil Evil Knievel (Robert Craig Knievel Jr.)? He is from Butte, Montana.

CC FLOW NO LONGER OFFERS AN ONLINE LINE OF CREDIT IN NEBRASKA

Nebraska

Need cash fast? Check out the CC Flow online Line of Credit Loan in Nebraska. Online loans in Nebraska range from $25 up to $4,000.

Wow! Nebraska is the birthplace of Kool-Aid, invented by Edwin Perkins in 1927 in Hastings, Nebraska. Nebraska also is nowhere near an ocean, yet there is a lighthouse that stands along the road in Ashland, Nebraska.

WE NO LONGER OFFER AN ONLINE LINE OF CREDIT IN NORTH DAKOTA

North Dakota

If you live in Indiana and need cash fast, CC Flow is here to help. CC Flow offers an online Line of Credit Loan up to $4,000 to help with life's financial challenges.

Did you know that on Sept. 5, 1885, the first gas pump was born in Fort Wayne, Indiana? The Indianapolis 500, also known as "The Greatest Spectacle in Racing," takes place in the state's capital.

Ohio

If you're in need of fast cash and live in Ohio, you could qualify for a CC Flow online Line of Credit Loan ranging from $25 up to $4,000.

Did you know that Ohio takes its name from the Ohio River. Ohio originated from the Iroquois word ohi-yo', which means "great river."

Oklahoma

You're a hard-working Oklahoman, but sometimes you need a little help making ends meet. The CC Flow online Line of Credit Loan could be just the ticket. With this loan, you could borrow up to $4,000 in Oklahoma. Plus, our easy online application process makes it simple to get started.

Did you know that Oklahoma has produced more astronauts than any other state.

South Carolina

If you're in need of cash in South Carolina, look no further than Advance Financial. We offer an online Line of Credit Loan in South Carolina ranging from $610 up to $4,000.

Did you know that musicians James Brown and Chubby Checker and politician Jesse Jackson are all from South Carolina?

Tennessee

Advance Financial offers a Line of Credit Loan from $25 up to $4,000 in the great State of Tennessee. You can apply online or visit any one of our over 100 stores from Millington to Bristol.

Advance Financial is proud to call Tennessee home. There are tons of things to see and do in Tennessee including Graceland, the place Elvis Presley called home, Dollywood and the Great Smoky Mountains.

Texas

If you live in Texas, the land of the longhorn, and need cash fast, check out the CC Flow online Line of Credit Loan. You could borrow up to $4,000 in Texas.

Texas is famous for lots of things, i.e. BBQ, cowboy boots, crude oil, longhorn cattle and the heat. But did you know that the Johnson Space Center is located in Houston, Texas? "Houston, we have a problem" is a famous phrase that is tied to the Apollo 13 mission to the moon in 1970.

Utah

If you're in need of fast cash and live in Utah, you could qualify for an Advance Financial online Line of Credit Loan ranging from $100 up to $4,000.

Did you know Utah got its state name from the Ute Indians and means people of the mountains.

Washington

If you live in Washington and need cash fast, check out the CC Flow online Line of Credit Loan. You could borrow up to $4,000 in Washington.

Washington is famous for the Space Needle which towers over Seattle. The 605-foot-tall iconic observation tower is a landmark that was built for the 1962 World's Fair.

Wisconsin

Advance Financial offers both a Line of Credit Loan and an Installment Loan in Wisconsin. You simply apply online and we'll determine which loan you qualify for.

Did you know that Wisconsin is known as America's Dairyland because it's one of the nation's leading dairy producers, particularly known for its cheese.